Fair Money

Providing easier access to short term loans.

FairMoney is a licensed online lender, that provides instant short-term loans to its customers with the promise of getting money disbursed into their bank accounts in less than 5 minutes without any collaterals.

The current loan application experience deployed on the mobile app isn’t so typical as it struggles to onboard new users and the loan aplication process isn’t efficient. For a product looking to acquire new users, parts of its onboarding fell short of expectation leading to numerous drop-off points.

To solve the problems stated, we set out to create features for the product that ensures a seamless and efficient experience across all corners of the app. We ran 4 weeks of design sprints based on the design thinking methodology, which includes 5 stages: empathize, define, ideate, prototype and test. We eventually created and shipped a fully functional product where people can access loans in minutes.

Role:

Contributor

Industry:

Finance

context

Inefficient Onboarding Process: FairMoney's existing loan application process was slow and led to numerous drop-offs, as new users found it difficult to navigate.

Unclear Eligibility & Feedback: Users were frustrated with not knowing their loan eligibility upfront and not receiving timely feedback on their applications.

Complex Loan Application: The lengthy application process, combined with a lack of transparency in loan and interest breakdown, caused friction and frustration.

How Might We?

Streamline Onboarding: How might we create a faster, more user-friendly onboarding process that improves retention and makes it easier for users to apply for loans?

Improve Loan Transparency: How might we give users clear and upfront information about their loan eligibility, loan terms, and interest rates?

Optimize Loan Application Process: How might we simplify the loan application process to reduce friction and provide users with quicker access to loans?

Research, iteration & design

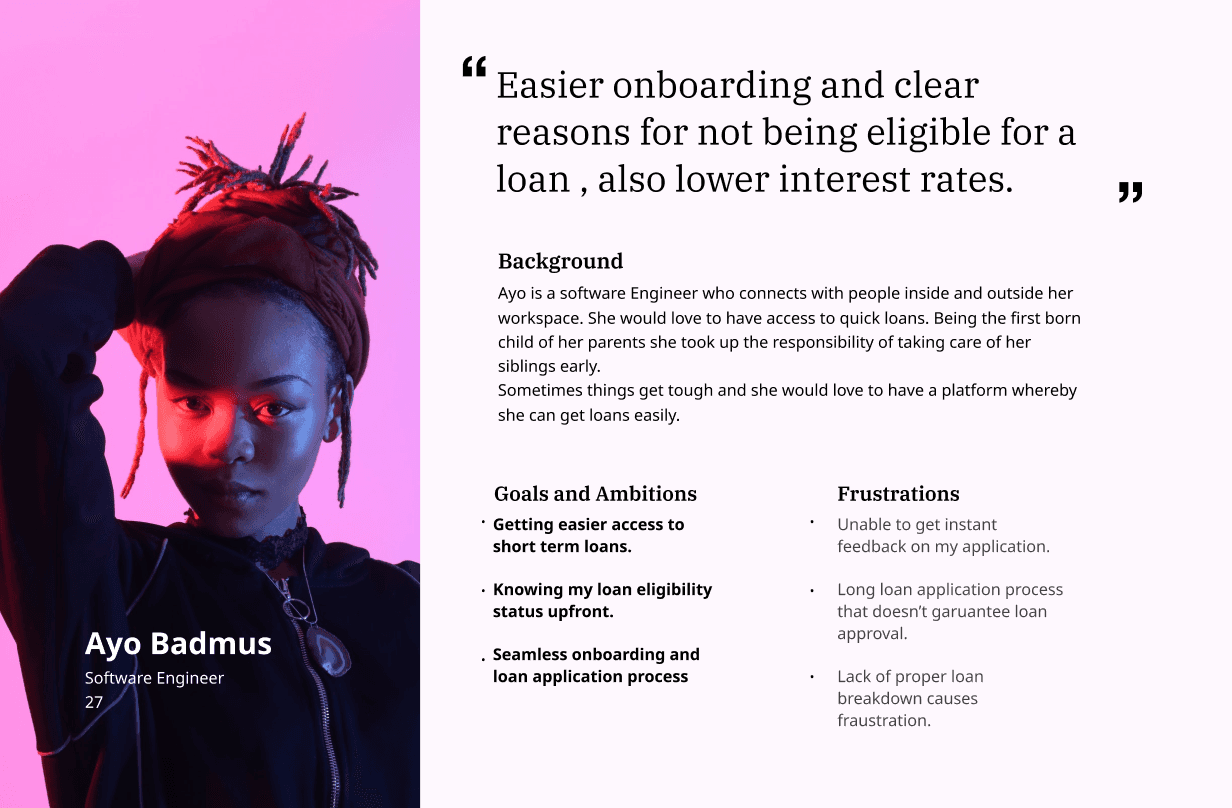

We conducted a survey targeting customers who frequently use loan-related products. We aimed to capture their pain points, needs, and expectations, gathering feedback on how to improve the loan application experience. Using quantitative research allowed us to reach a larger audience and collect valuable data.

Time-Consuming Application: Users were frustrated with the long process of filling forms and not knowing if they were eligible for a loan until the end.

Poor Feedback Mechanisms: Users expressed dissatisfaction with the delayed feedback on their loan applications.

Loan Breakdown Issues: Many users found it difficult to understand their loan and interest breakdowns, leading to confusion and hesitation during the application process.

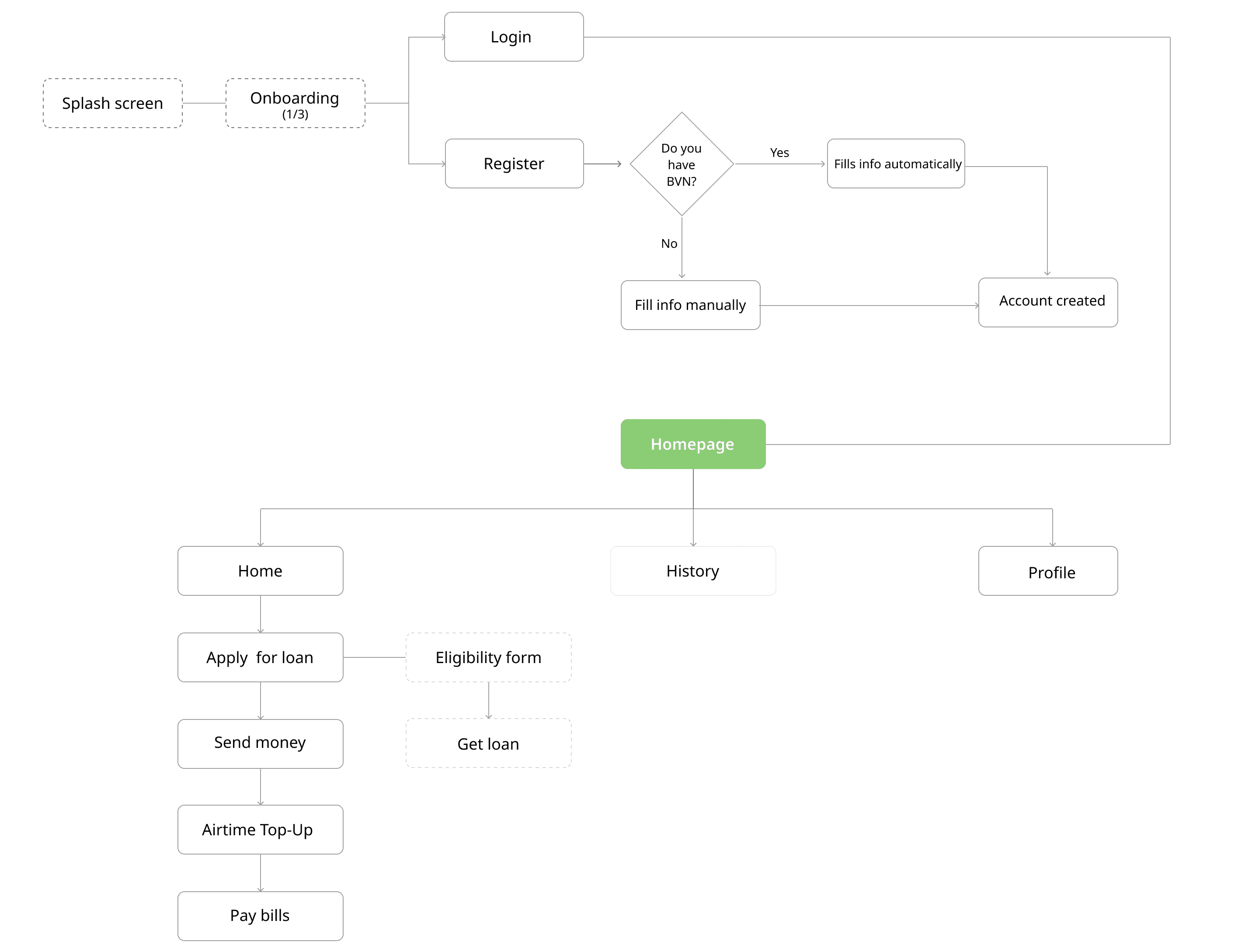

The user flow was mapped to guide Ayo from onboarding through loan application and disbursal, ensuring each step was optimized for clarity and efficiency.

Optimized Onboarding: We simplified the registration process by allowing users to sign up using their BVN (Bank Verification Number), which automatically fills in their information, saving time and reducing errors.

Loan Eligibility Form: Introduced an eligibility form that lets users know upfront if they qualify for a loan, cutting down on wasted time.

Loan Breakdown Transparency: Added detailed screens to show a clear breakdown of loans and interest rates, so users know exactly how much they owe and by when.

Simplified Loan Application: Broke down the loan application process into three concise steps, with circular progress bars to keep users engaged and informed throughout.

Impact

The redesigned FairMoney app with 10M+ downloads, improved the loan application experience significantly, reducing the number of drop-offs and making the process faster and more intuitive. Users appreciated the transparency around loan eligibility and interest rates, as well as the simplified onboarding process. Overall, the app now provides a more efficient and user-friendly way to access short-term loans, resulting in higher user satisfaction and quicker loan disbursals.